25+ Net Pay Calculator Maryland

Web Calculate your Maryland net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free. Due to changes to the Federal W-4 form in 2020 there are now two versions of the Net Pay Calculator.

Maryland Salary Paycheck Calculator Gusto

Customize using your filing.

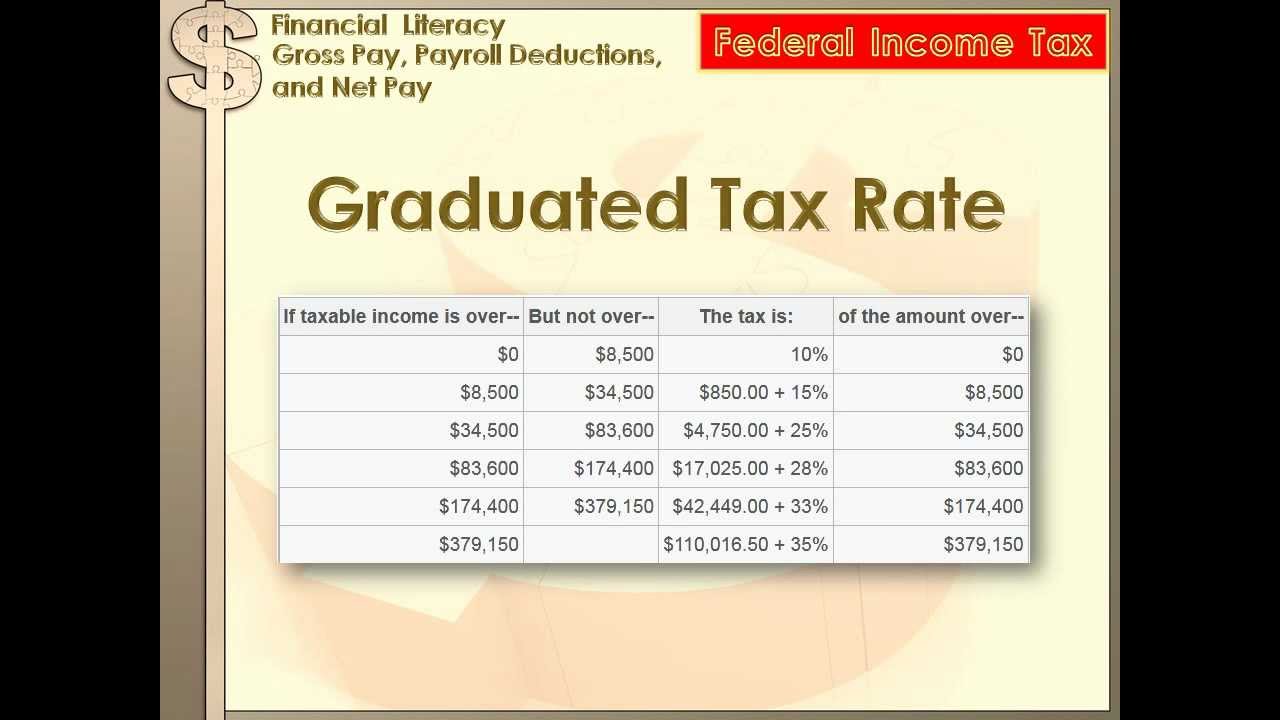

. If you make 70000 a year living in Maryland you will be taxed 11177. Your average tax rate is 1167 and your. Web Net Pay Calculator - The net pay calculator can be used for estimating taxes and net pay.

See payroll calculation FAQs below. Web This version of Net Pay Calculator should be used by those who submitted Federal W-4 in 2020 or later. Web The net pay calculator can be used for estimating taxes and net pay.

This net pay calculator can be used for estimating taxes and net pay. These rates of course vary by year. If your total income will be 200k or less 400k if married multiply the number of children under 17 by 2000 and other dependents by 500.

Web For 2023 Marylands Unemployment Insurance Rates range from 1 to 105 and the wage base is 8500 per year. In order for Central Payroll to calculate Net Pay Taxes. Employer Withholding Calculator - Tax.

Web Maryland Income Tax Calculator 2022-2023. Web Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and. Web Heres how to calculate it.

Due to the recent changes to the tax law the IRS is encouraging everyone to use the Withholding Calculator to make sure you have the. Well do the math for youall you. If you make 55000 a year living in the region of Maryland USA you will be taxed 11574.

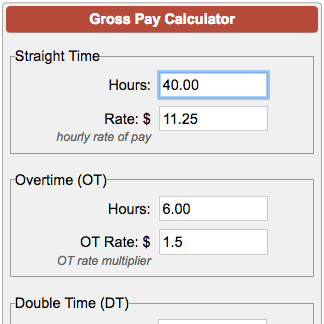

Web At the bottom of the paystub the calculation of gross to net pay is shown as well as the employees name and address. Web This Maryland hourly paycheck calculator is perfect for those who are paid on an hourly basis. Due to changes to the Federal W-4 form in 2020 there are now two versions of the Net Pay calculator available.

Web Maryland Income Tax Calculator - SmartAsset Find out how much youll pay in Maryland state income taxes given your annual income. Switch to Maryland salary calculator. Before you start youll need a copy of your pay stub for reference.

That means that your net pay will be 43426 per year or 3619 per. Web Use this calculator if you are a nonresident of Maryland and have income subject to Maryland tax in 2021. Web Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Maryland.

Web IRS Withholding Calculator. Web The net pay calculator can be used for estimating taxes and net pay.

101 Atlantic Avenue Ocean City Nj 08226 Compass

9518 Opossumtown Pike Frederick Md 21702 Mls Mdfr2027844 Zillow

How Do I Calculate A Gross Up Wage For A Supplemental Or Bonus Check

Free Maryland Payroll Calculator 2023 Md Tax Rates Onpay

Financial Literacy Gross Pay Payroll Deductions Net Pay 8th Grade Math Youtube

Paycheck Calculator Take Home Pay Calculator

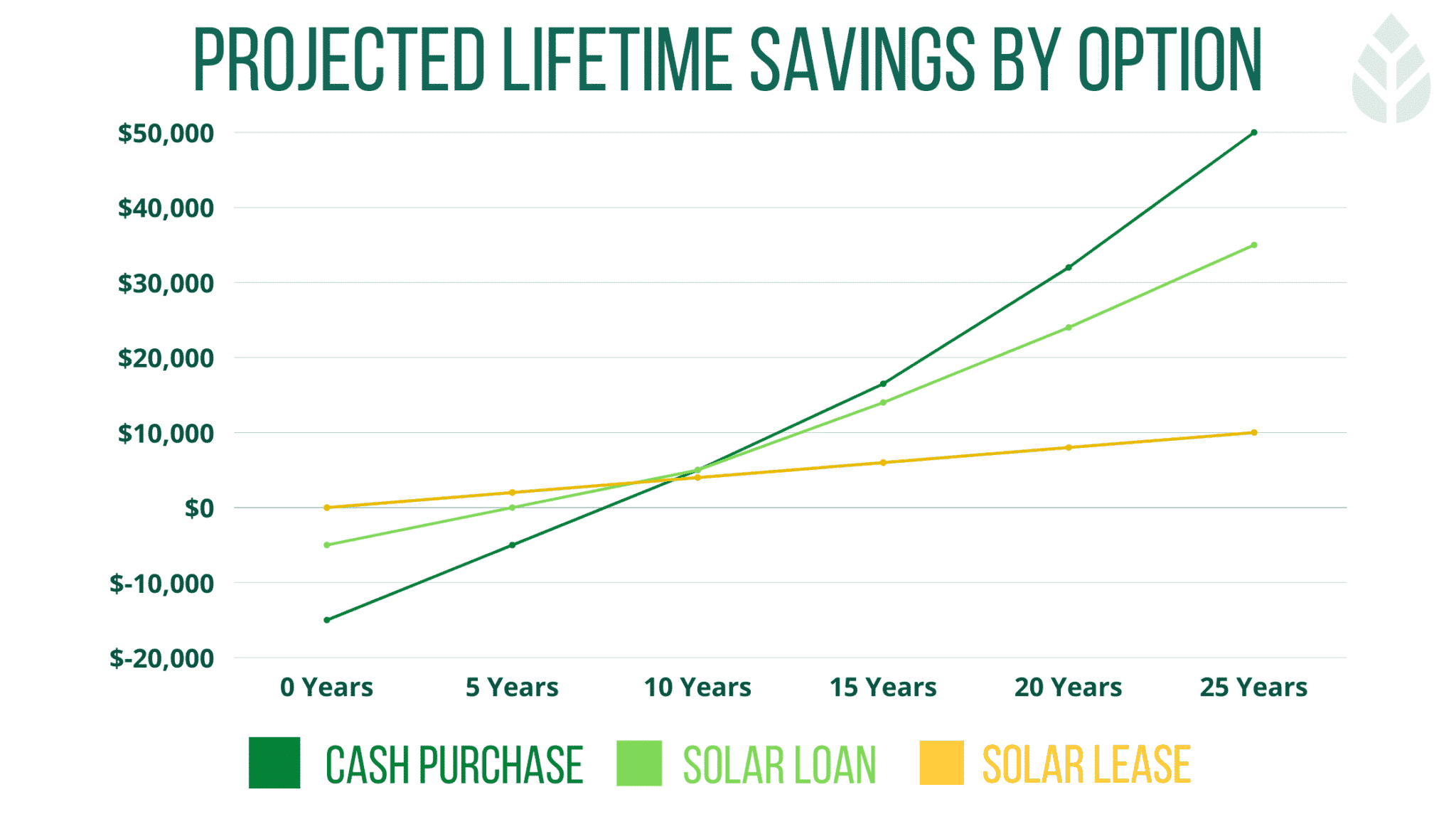

Is Solar Worth It In Maryland 2023 Homeowner S Guide

Gross Pay Calculator

Maryland Salary Paycheck Calculator Paycheckcity

Harbor Place Apartment Homes Fort Washington Md Trulia

Calculate The Mean And Standard Deviation For The Following Table Given The Age Distribution Of A Group Of People Age 20 30 30 40 40 50 50 60 60 70 70 80 80 90 No Of Persons 3 51 122 141 130 51 2

Take Home Pay Calculator

Best Western Capital Beltway Lanham Md 5910 Princess Garden Pkwy 20706

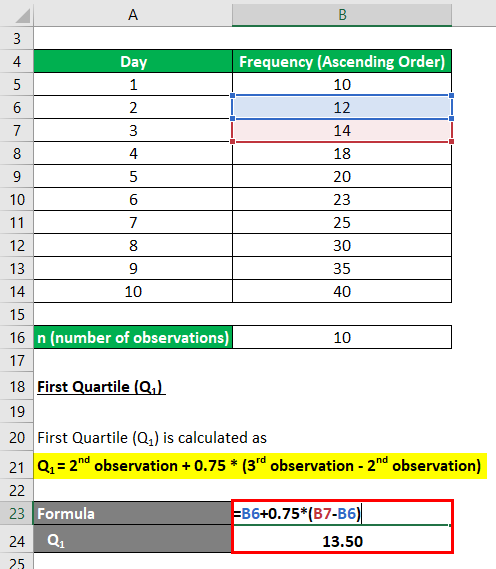

Quartile Deviation Formula Calculator Examples With Excel Template

Tm2127192d1 Ex99x1x20 Jpg

![]()

Acp Advances In Air Quality Research Current And Emerging Challenges

Calculate Take Home Pay